Yahoo Finance confirmed this morning that Pernod Ricard is moving toward a takeover of drinks giant Allied Domecq.

"The board confirms that it is in discussions with Pernod Ricard, which is working with Fortune Brands, regarding a potential offer for Allied Domecq by Pernod Ricard," Allied said in an official statement.

"These discussions are at an early stage and there can be no certainty that an offer will ultimately be forthcoming."

Investors toasted the news as the share price in Allied Domecq rocketed 17.88 percent to close at 633 pence in

In

"Preliminary contacts have been made between Pernod Ricard and Allied Domecq," a Pernod spokesman said, adding that it was too soon to tell if the initiative would bear fruit.

Pernod jumped 5.11 percent to close at 113.20 euros in

The announcements followed press speculation at the weekend over a possible deal for Allied Domecq, makers of Beefeater gin, Perrier Jouët champagne and

Fortune Brands -- which produces Jim Beam bourbon -- had appointed Swiss bank Credit Suisse First Boston to target acquisitions in the European drinks sector, The Sunday Times said.

That could include participating in a possible 6.5-million-pound (9.5-million-euro, 12.2-million-dollar) bid for Allied Domecq, the weekly added.

There would be "significant distribution synergies" from the possible takeover, stockbrokers Panmure Gordon said Tuesday.

Competition issues were limited as Allied's brand portfolio could be divided between both Pernod and Fortune Brands without incurring the wrath of regulators, they said.

"There will be a lot of regulatory interest in any offer. We are still in the foothills of what could be quite a long slog," added Jeremy Batstone of Charles Stanley Stockbrokers.

Fortune would likely take over some Allied brands to sidestep competition issues arising from some overlapping products, such as Pernod's Martell and Allied's Courvoisier cognac labels.

"The only overlap is maybe in cognac, and you can imagine a problem perhaps in the

The resulting drinks giant would be better-placed to compete against market leader Diageo (LSE: DGE.L - news - msgs), which produces Johnnie Walker whisky and Smirnoff vodka, analysts said.

"A combined group would likely have a similar market share to Diageo with similar portfolio and geographic strengths," said analyst Hilary Cook, of Barclays Stockbrokers.

Any offer from Pernod could flush out other bidders, such as Diageo, previously said to be interested in Allied's wine brands, analysts said.

Allied, which has 13,000 staff worldwide, owns also Stolichnaya vodka, Tia Maria and food brands Dunkin Donuts and Baskin-Robbins.

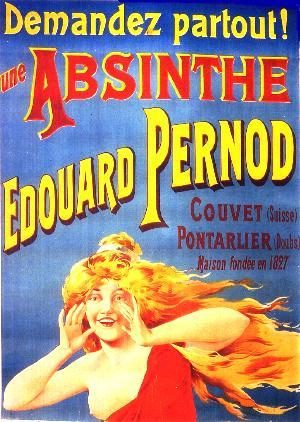

Key brands in the Pernod portfolio include Havana Club, Jacob's Creek, Jameson and Martell.

quicksearch

quicksearch